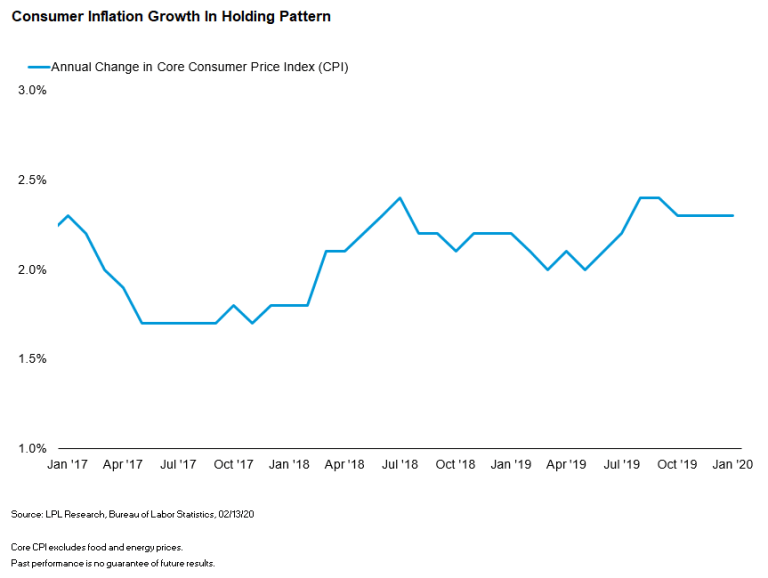

Consumer Inflation Growth In Holding Pattern

Consumer inflationary pressures grew at a moderate rate in January 2020.

The core Consumer Price Index (CPI), which excludes food and energy, rose 2.3% year over year last month, near the fastest pace of this economic cycle and in line with recent months. As shown in the LPL Chart of the Day, core CPI growth has been steady, thanks to firm U.S. demand and relatively benign producer price and wage growth.

In recent months, investor concerns have toggled between the future path for inflation potentially becoming too low or too high. Inflation significantly lower than the Federal Reserve’s (Fed) 2% target can signal a lack of aggregate demand and potential economic weakness, while runaway inflation erodes purchasing power and can force the Fed to raise interest rates. We believe, though, that the current trajectory of inflation presents a supportive middle ground for the economy.

“Inflation continues to grow at a healthy pace, which should provide a stable platform to enable future economic growth,” said LPL Financial Chief Investment Strategist John Lynch. “The Fed has signaled its reluctance to change its policy interest rate unless it observes a material change to its economic outlook, and this report will do little to change its projections.”

While the widely tracked core CPI number is slightly north of the Fed’s 2% target, the Fed’s preferred inflation gauge, core Personal Consumption Expenditures (PCE), has persistently come in below target. Historically, year-over-year core CPI growth has run 25 to 50 basis points (0.25–0.5%) higher than core PCE, so January’s core CPI reading likely hints at a continued PCE undershoot and sidelined Fed. January core PCE data is released on February 28.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). finra.org / sipc.org

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

For Public Use – Tracking 1-951249