Don’t Fear the Repo

The fourth quarter is winding down, and investors are getting nervous that volatility in the short-term lending market could flare up once again.

Rates on repurchase agreements (repos) jumped in September 2019 amid a shortage of cash available to lend, forcing the Federal Reserve (Fed) to restore balance in the system by purchasing U.S. Treasuries and other securities from firms. We covered that episode in our blog, “The Repo Market’s Perfect Storm,” on September 27.

The Fed’s actions eventually stabilized repo rates, and financial markets ultimately shrugged off the issue. The S&P 500 Index has climbed 7.3% since the end of September, and other credit markets barely registered the event.

“September’s bout of volatility was concerning, but it was the perfect storm of unusual circumstances,” said LPL Financial Chief Investment Strategist John Lynch. “Volatility in the repo market could increase as quarter-end nears, but we expect a Fed intervention will smooth any bumps out.”

Here are a few reasons we’re not concerned about a repo-market meltdown:

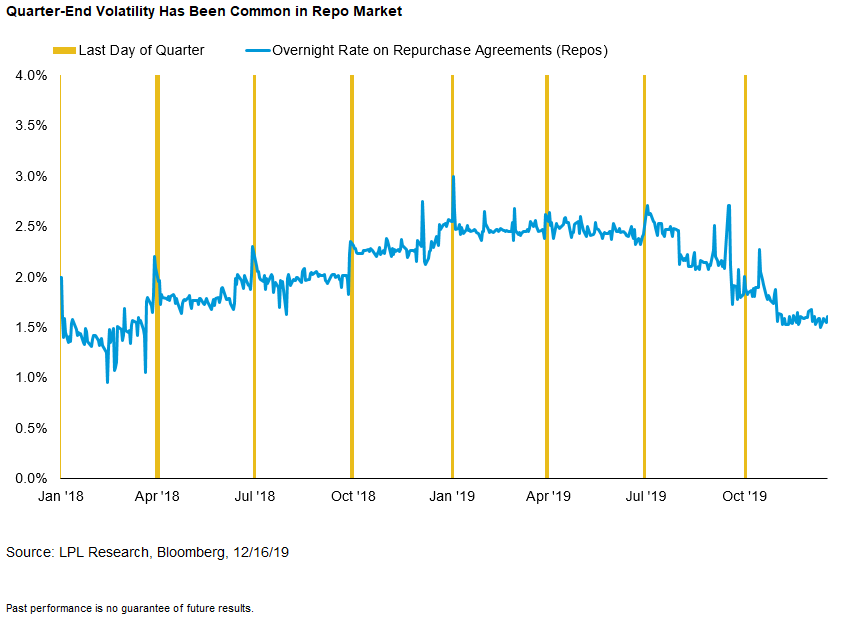

Repo market volatility has been seasonal. As shown in the LPL Chart of the Day, repo market liquidity gaps are common around quarter-end as corporate demand for cash typically increases.

To be sure, market dynamics could increase the likelihood of liquidity gaps. Treasury issuance will likely remain high amid a ballooning U.S. budget deficit, and companies’ cash needs will persist.

The repo market has shrunk considerably. It’s unlikely that repo market liquidity gaps will become systemic issues. The repo market is a fraction of the size it was before the 2008 financial crisis, when surging lending rates ultimately led to a significant breakdown in fixed income markets.

Even September’s episode was relatively localized. The overnight repo rate jumped about 60 basis points (0.6%), a move that pales in comparison to the repo market swings in late 2007. The 1-month London Interbank Offered Rate (LIBOR) climbed less than 10 basis points (0.1%) over the same period. These rates settled down quickly, thanks to the Fed’s quick action.

The Fed is watching. The Fed has enacted minor liquidity measures in repo markets for several years now. Since September, policymakers have ramped up discussions about long-term repo market solutions. In October, the Fed announced it would buy about $60 billion in Treasury bills per month to boost banks’ excess cash balances. The Fed has also committed to injecting liquidity in the repo markets as needed.

To paraphrase Blue Oyster Cult, “don’t fear the (repo).”

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (Member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not insured by FDIC or NCUA/NCUSIF or Any Other Government Agency | Not Bank/Credit Union Guarantee | Not Bank/Credit Union Deposits or Obligations| May Lose Value

Member FINRA /SIPC

For Public Use | Tracking #1-929063