Healthy But Manageable Consumer Inflation

Consumer inflationary pressures grew at a healthy, but manageable rate in December 2019.

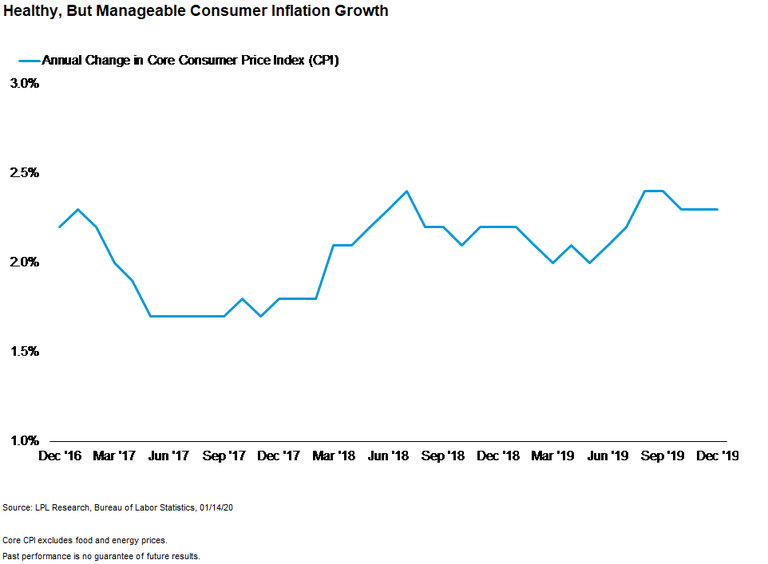

The core Consumer Price Index (CPI), which excludes food and energy, rose 2.3% year over year last month, around the fastest pace of the economic cycle. As shown in the LPL Chart of the Day, core CPI growth has been steady, thanks to firm U.S. demand, despite slowing producer price and wage growth.

Inflation concerns are back in the spotlight after the December 2019 jobs report showed year-over-year wage growth for nonsupervisory workers slowed to 3%, a 15-month low. However, today’s CPI data shows companies still have ample pricing power, a good sign for future profits and economic durability.

“Modestly rising inflation is a healthy trend in this macroeconomic environment,” said LPL Financial Chief Investment Strategist John Lynch. “Even though slowing wage growth is worth watching, 3% growth is a still a pace that could buoy profit margins while still supporting consumer spending.”

Right now, inflationary pressures are right where we want them to be, especially through the lens of monetary policy. Ensuring stable inflation is one half of the Fed’s dual mandates, and year-over-year growth in core Personal Consumption Expenditures (PCE) is right below the Fed’s 2% target.

Historically, year-over-year core CPI growth has run 25 to 50 basis points (0.25–0.5%) higher than core PCE, so December’s core CPI reading could hint to year-over-year core PCE growth just below 2%. That level of growth would support a Federal Reserve pause in interest rate changes. We’ll get December core PCE data January 31.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges, Index performance is not indicative of the performance of any investment.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

All performance referenced is historical and is no guarantee of future results.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Member FINRA/SIPC

For Public Use – Tracking # 1-937705