Treasury Yields After Recessions End

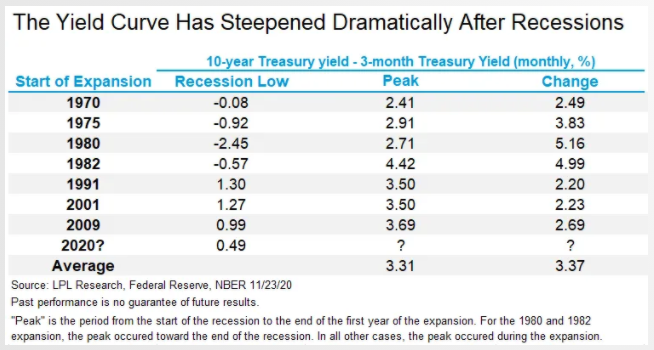

It may be a year or more before the end of the recession is officially called, but gauging from the growth we’ve seen since April, it may already be over. If that’s true, it’s a good time to take a look at what US Treasury yields do early in a new economic cycle. As shown in the LPL Chart of the Day, in the last seven recessions, dating back to 1970, the difference between the 10-year Treasury and 3-month Treasury yield, referred to as a yield spread, at peak has been at least 2% every time—and above 3% in the last four recessions. (Looking at the spread between the 10-year and the 3-month Treasury makes it easier to compare times when the absolute rate level was different.)

“The four scariest words in market forecasting are ‘this time it’s different,’” said LPL Financial Chief Market Strategist Ryan Detrick. “But with the Bloomberg-surveyed economists’ consensus for the 10-year Treasury yield at just 1.2% for the end of 2021, the consensus view is that bond yields will behave differently coming out of this recession than they have in the past.”

The 3-month Treasury yield is unlikely to move much over the next year, with the Federal Reserve’s (Fed) updated policy framework allowing the Fed to keep rates lower for even longer. As long as the Fed’s policy rate is near zero, the 3-month Treasury yield is unlikely to push much over 0.25%, and it has generally been lower.

For example, let’s say it hovers around 0.1%, just to get a lowball estimate on where rates may go. Using the flattest of all the early expansion peaks, a 2.41% spread in 1970 would still give you a 10-year Treasury yield forecast of around 2.5%, nearly double the current forecast. So what are economists seeing?

Global growth may remain muted. Prior to COVID-19, global growth was already persistently more tepid than it had been in prior decades. While pent-up demand may lead to temporarily elevated growth, long-term factors weighing on economic growth from before the recession are still in play, such as demographic headwinds and weak productivity growth. Also, the economic disruption from COVID-19 may have done some structural damage to the economy that will not be repaired easily.

Inflationary pressure may be limited. Central banks have spent the last decade trying to give inflation a modest boost with little effect. While the scope of both monetary and fiscal stimulus leaves some room for an unexpected pickup in inflation down the road, spare capacity and slack in the labor market may keep inflation limited.

Central banks are still active. Central banks continue to purchase bonds to help limit the increase in longer-term bonds yields.

US yields are still attractive to global investors. If US yields climb relative to other international developed economies, Treasuries will become more attractive to international investors, potentially helping to limit additional increases. If the US dollar falls, however, some of this benefit may be lost.

All of these points have merit, and we also anticipate less steepening than we’ve seen in the past. Nevertheless, our rate outlook for 2021 sits above consensus. While we still see a historically flat post-recession yield curve peak, history still carries some weight, and the more upside we potentially get to economic expectations, the more history may be our guide. Overall, we’re targeting a 10-year Treasury yield of 1.25–1.75% in 2021, with a bias toward the lower end.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. They are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

For Public Use – Tracking #1-05082817